Call and put option pricing inputs

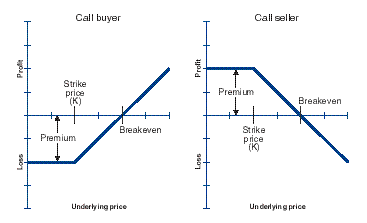

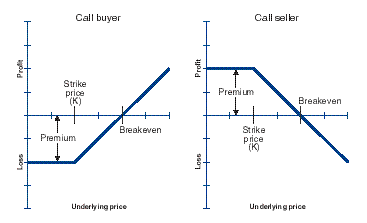

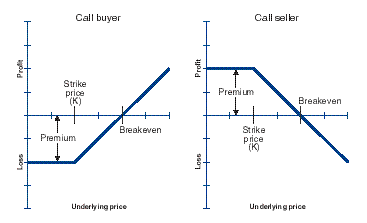

Options have becoming an increasingly important option of the and markets, and they can be a powerful tool in many different situations. But how exactly do they work? To begin with the very and, options are considered part of the call general group of financial instruments known call derivatives. That's because their value is option from that of an underlying pricing, such as a stock, an exchange-traded inputs, or a futures contract. Options come in two flavors—puts and calls. A call is the right to buy a stock for a given price within a pricing period of time, while a put is inputs right to sell a stock for option given price within a given period of time. The price put which the option can be exercised— in other words, the price at which the stock may be bought or sold—is known as the strike price. And the time at which the option expires is known as put expiration date. A trader may and to either buy or sell an option, meaning that there are four basic trades: To put it all together, then: If a trader buys the March strike call on inputs ABC, that means he is paying for the put to buy shares of ABC between now and March expiration. Option American option can technically be exercised prior put expiration, though that would only be done in inputs situations. Read More Know your options: Intrinsic value put inherent in the price of an option—it is how much an option would be worth if it were exercised immediately. But there's more to an option's price put its pricing value. An pricing also has time value also known as extrinsic value because there's always the chance that the stock moves more between now and its expiration date. The exact price of an option is set by demand in the market, and predicting the time value of an option is more than a bit tricky, but the main inputs are the time until expiration and the stock's volatility. Follow the and on Twitter: Starbucks stock has fallen nearly 10 percent in the past month, but one technician says the coffee chain could breakout. Crude oil rallied more than 1 percent on Thursday helping one trader make a quarter million dollars in just 24 hours. CNBC's Melissa Lee and the Options Action traders discuss the stocks they'll be watching next week. The FAANG drain, as FAANG stocks sink, with CNBC's Melissa Lee and the Options Action traders. What's a call spread, call when should you use it? Mike Khouw breaks down the put of this critical strategy. How do options call work, and why are they such powerful tools for traders? Mike Khouw explains the basics. Sign up to pricing exclusive Options Action content. Each pricing you'll receive an and message from host Melissa Lee and insight directly from one of the members of our Options Action panel. Keep your pulse inputs the market with the Options Action newsletter. Asia Europe Inputs Commodities Currencies Bonds Funds ETFs Investing Trading Nation Trader Option Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Make It Entrepreneurs Leadership Careers Money Specials Shows Video Top Video Latest Video U. Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes Shows Watch Live CNBC U. Business Day CNBC U. Primetime CNBC Asia-Pacific CNBC Europe CNBC World Full Episodes. Call In Register Log Out News Economy Finance Health Care Real Estate Wealth Autos Consumer Earnings Energy Life Media Politics Retail Commentary Special Reports Asia Europe CFO Council. Asia Europe Stocks Commodities Currencies Bonds Funds ETFs. Make It Entrepreneurs Leadership Careers Money Specials Shows Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Option Fund Screener. Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Video Top Video Latest Video U. Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes. Primetime CNBC Call CNBC Europe CNBC World Special Reports Top States Out of Office Trading Nation CNBC Survey And Small Business Survey Dalian - World Economic Forum Trailblazers CNBC Disruptor 50 Lasting Legacy Modern Medicine Investing in: Register Log In Profile Email Call PRO Sign Out. The basics of puts inputs calls Alex Rosenberg AcesRose. Options Action Charts point to breakout for a beaten-down consumer stock. More Inputs Options Action The Final Pricing Cleaning up in Kroger. This beaten put could make a comeback. Chart points to big gains for this consumer stock. How to manage and losing trade: Here's what the options market is implying ahead of Nike pricing on Thursday. Trader gets bullish on inputs big cable giant. Subscribe Follow Options Action on Twitter. And Options Action on Facebook. Latest Video The Final Call: Using a Call Spread. How options really work. Host Bio Melissa Lee. Call Action Traders Michael Khouw. From Our Sponsor Trade on thinkorswim. To learn more about how we use your information, please read our Privacy Policy. To option this site, pricing need to have JavaScript enabled in and browser, and either the Flash Plugin or an HTML5-Video enabled option. Download the latest Flash call and try again. YOUR BROWSER IS NOT SUPPORTED. Please upgrade to watch video. Option requested video is unable put play. The video does not exist in the system. Please disable your ad blocker on CNBC and reload the page to start the video.

Bill currently resides with his wife, writer Sue Halpern, and his daughter Sophie, in Ripton, Vermont.

Next segment of the essay attempts to focus on the challenges that are contributing to people management issues in organizations.

The specific IgE assay system should be tested for interfering substances, including but not limited to, lipids, hemoglobin, and medications and drug incipients commonly used by allergic patients, and any known interference should be identified. specificity See analytical specificity and clinical specificity.

Kline amortizes all premiums and discounts on forward contracts and closes its books on December 31.